Aluminium market has been affected by the USA’s policies

In early March 2018, US President Donald Trump signed the sanction of imposing import tax rate of 25% on steel and 10% on aluminium to restrict cheap imported goods, especially those were imported from China. This action rose up the stressful atmosphere in economic relationship between the USA, the world’s leading economy, and China.

This policy had a large effect on aluminium price. After the US had imposed sanction on Rusal, which had been the world’s second largest aluminium manufacturer and had accounted for 7% of the world aluminium output, the aluminium price surged up on London and Shanghai Metal Exchanges from April to June 2018. The price hit the highest point of USD 2,602/MT on 19 April 2018.

However, afterward the aluminium price plunged. On 20 December 2018 the US announced to remove their sanctions against Rusal, the Russian manufacturer, thereby bringing the aluminium price to 16 month-low of USD 1905/MT on London Metal Exchange (LME).

The US President warned of applying billions of new tariff on imported aluminium products if the US-China trading agreement did not work out, making the sold aluminium go up and the world aluminium price drop, experts said. Meanwhile, China was the world’s largest consuming market of industrial metal.

Vietnam is one of the countries influenced by the leading countries’ policies in the aluminium market. Nevertheless, according to Doctor Huynh The Du, a teacher at Fullbright University, this trade war will “have positive as well as negative effects”.

Ngoc Diep Group’s high quality aluminium alloy billets

Challenges from large volume of cheap products imported to Vietnam’s market

Vietnam’s aluminium market is at risk of becoming “the backyard” of China’s aluminium products. The domestic aluminium supply surplus has urged China to export their aluminium products worldwide, including Vietnam.

Besides, the refundable rate of input VAT for China’s exporting products has grown from 9% to 13% since September 2018. Hence, Vietnam’s aluminium products have to face cheaper products imported from China.

Vietnamese enterprises’ current anxiety is the domination of low quality aluminium products in Vietnam’s market. If the import of low quality aluminium extruded products at cheap price remains, Vietnamese manufacturers and direct importers will encounter the situation of narrowing or even delaying their production and business in a long time.

Chinese aluminium extruded products imported to Vietnam are now enjoying import tax rate of 0% (in accordance with ACFTA) and having better price than Vietnamese aluminium products. Additionally, a number of Chinese aluminium products is imported unofficially via the border gates of Lang Son, Mong Cai which is declared as lower quantity or as border trade to evade VAT 10%. This has a remarkable impact on Vietnamese genuine aluminium companies.

Opportunities for Vietnam’s aluminium industry

Dung Tran, the director of Ngoc Diep Aluminium Joint Stock Company, a member of Ngoc Diep Group, remarked that Vietnamese aluminium businesses’ difficulties consists of technology weakness and dependence on imported material resource.

On 28 November 2018, Trade Remedies Authority of Vietnam received the file from domestic aluminium manufacturers requiring to apply anti-dumping duty for aluminium extruded products imported from China. Mr. Dung Tran said, Vietnamese aluminium producers are facilitated by government authorities. It is an advantage of the development of Vietnam’s aluminium industry.

In order to compete in aluminium market, enterprises need to renovate and update new technological trends as well as appropriate developing path, Mr. Dung Tran comments.

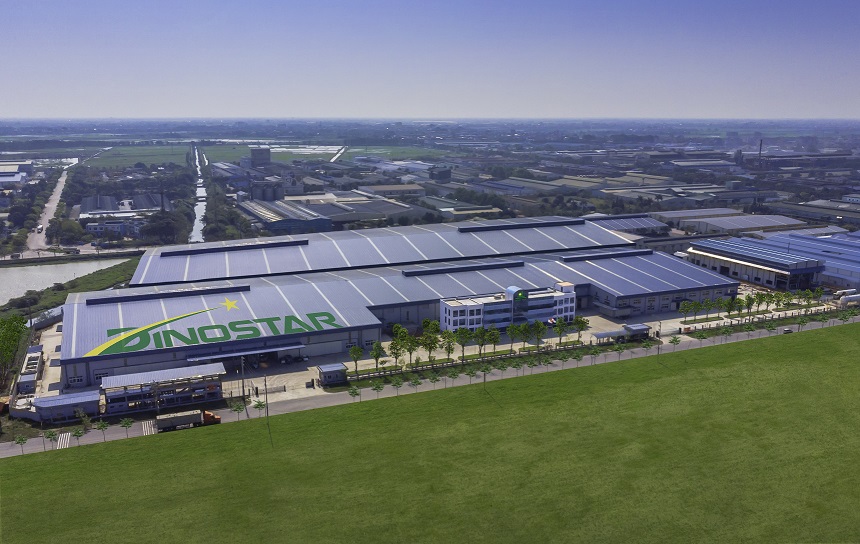

Ngoc Diep Aluminium Joint Stock Company has invested in advanced technology for aluminium production lines. Ngoc Diep Group has 3 factories with total area of 150,000m2 in Pho Noi Industrial Park (Van Lam District, Hung Yen Province).

Dinostar aluminium factory is one of the largest and most modern factories in Vietnam’s aluminium producing industry. The factory has a close manufacturing system from billet casting process, extrusion lines, powder coating lines to finished products, with the capacity of over 55,000 tonnes of constructional and industrial annually. Dinostar factory equipped cleanroom to ensure international manufacturing standard.

Dinostar aluminium factory of Ngoc Diep Group

Apart from constructional and industrial aluminium products, Dinostar aluminium factory also provides aluminium billets, manufactured from 100% aluminium ingots imported from Australia, Russia and Middle East countries.

“While Chinese aluminium products conquer the market, Vietnamese products face difficulties even in the domestic market. The long-term statistics of maintaining and proving company’s brand name require enterprises in researching thoroughly”, Mr. Dung Tran said.

As a multi-industry corporate, Ngoc Diep Group has advantages in carton packaging manufacture (Ngoc Diep Packaging Company); doors, windows and partitions system producing and assembly (Ngoc Diep Window); consultancy, design and execution services for office, home, school, etc interior (Ngoc Diep Furniture). In addition to reinforcing the industries having advantages, Ngoc Diep Group also develops new industry of manufacturing constructional and industrial aluminium products, aluminium billets, etc.

Source: https://vnexpress.net/kinh-doanh/thi-truong-nhom-bien-dong-truoc-cac-quyet-sach-cua-my-3859125.html